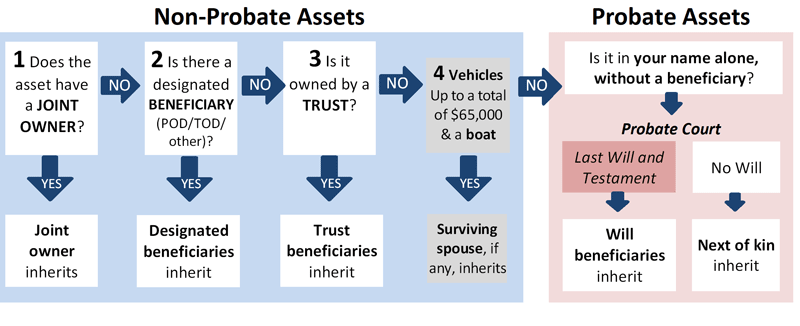

When a person passes away, there are several categories of how assets pass to beneficiaries. Understanding how your assets fit into these categories will help you determine what role probate court will play in your estate.

Non-Probate Assets

Non-probate assets transfer upon your death based on something other than your Will (like joint account rules at your bank, beneficiary designations on an asset, or Ohio statute). Non-probate assets can be claimed by the beneficiaries without involvement of the probate court. Your Will does not control these assets.

- Any asset held as joint tenants with rights of survivorship (JTWROS) will pass directly to the surviving joint owner. Most joint assets are held in survivorship. Occasionally, joint property can be owned as “tenants in common.” In that case, the deceased owner’s share will be a probate asset. We see joint ownership as tenants in common most often with real estate that was purchased before 1980, or real estate owned jointly with a non-spouse.

- Assets with beneficiary designations may include life insurance policies, 401(k)s, IRAs, annuities, and any assets with a pay-on-death (POD) or transfer-on-death (TOD) designation. These assets will pass directly to the beneficiary or beneficiaries who are designated (for instance, on an IRA application, life insurance application, change of beneficiary form, transfer-on death designation affidavit for real estate, or directly on your car title.) Some retirement account agreements or life insurance policies include a default beneficiary designation.

- Assets held in the name of a Trustee or name of the trust or with the trust/Trustee designated as the beneficiary will be held and distributed by the Trustee, according to the terms of the trust.

- For married couples: In Ohio, multiple vehicles, with a combined total value of less than $65,000, plus one boat, can be transferred to a surviving spouse directly without going through probate court. This law does not cover motor homes or trailers.

Probate Assets

Probate assets are those assets held in your individual name with no living joint owner, and no beneficiary designation (or no living beneficiary), and not held in a trust, and which are not a vehicle or boat being transferred to a surviving spouse. These assets are required to be claimed by an Executor or Administrator who is appointed by the probate court. Net assets after debts/expenses are distributed according to your Will, and if there is no Will, to your next-of-kin, according to Ohio law.

When you are deciding who will benefit from your estate and to what degree, it is important to consider both your probate and non-probate assets. Even if you have a trust, you may end up with probate assets if asset ownership and beneficiary designations are not updated appropriately. As you acquire new assets in the future, if you have questions about the appropriate ownership or beneficiary designations for your individual situation, please give us a call.

![]() For a printer-friendly PDF of this article, click here

For a printer-friendly PDF of this article, click here

Related FAQs:

- Do I need an attorney to handle any estate?

- What should executors know?

- What steps should a surviving spouse take?

- Death certificates: how many do I need?

< Back to Frequently Asked Questions